This is because ownership of privately owned companies is commonly held by only a few investors, in comparison with publicly-traded IFRS corporations where shares are held by many buyers. This allocation course of could be cumbersome and will require more time, effort, and professional judgment. A typical format for a statement of comprehensive earnings for a business is proven within the example beneath. Examples of transitory gains and losses are people who arise on the remeasurement of outlined benefit pension funds and revaluation surpluses on PPE.

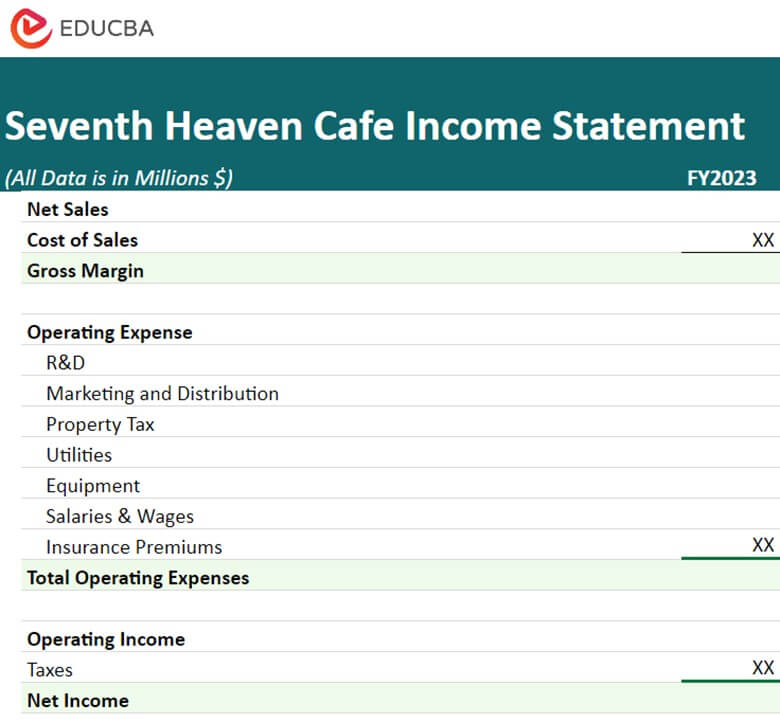

The difference can be acknowledged as both a gain or loss in the OCI line item of the stability sheet. So, you’ll see Price of Items Offered damaged out into its personal section, with Gross Revenue calculated as the Internet Gross Sales minus Cost of Goods Offered. The second worksheet, proven on the best, is a multi-step income statement that calculates Gross Revenue and Working Earnings. PROCHECK is an expert agency devoted to delivering assurance & advisory, tax, and consulting services to assist companies obtain compliance, transparency, and sustainable progress. With deep expertise and business expertise, we support firms in managing regulatory necessities, optimizing tax strategies, and enhancing operational effectivity.

The revenue statement of a sole proprietorship doesn’t report an expense for the proprietor working within the business. As a outcome, the web earnings of a sole proprietorship can’t be instantly in comparability with the web earnings of an everyday company the place the owner is paid a wage. The heading of a comparative annual revenue statement might be modified to learn “Years ended December 31″ (since three years of income statements are proven. The years might be indicated at the prime of every column of amounts. In the case of $ENS, an analyst figuring out concerning the presence of high elements of Different Complete Revenue may additionally observe the money circulate assertion. There, you can see the overseas change results on its cash and cash equivalents, which have decreased the worth of that money all by itself.

- The primary elements include unrealized features and losses, overseas foreign money translation changes, and pension plan gains and losses.

- However, from a tax perspective, the recognition of items in other complete earnings (OCI) doesn’t necessarily align with tax liabilities.

- The Statement of Complete Earnings includes various key elements such as operating earnings, non-operating revenue, Other Complete Income (OCI), and the tax impression on OCI.

- For the past fifty two years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university teacher, and innovator in instructing accounting on-line.

- Underneath the accrual foundation of accounting, revenues are recorded on the time of delivering the service or the merchandise, even if money isn’t acquired on the time of supply.

Modifications In Reporting Standards And Practices

After the 30 loaves are sold, ABC shall be increasing its web income by $7 for each https://www.simple-accounting.org/ additional loaf offered. The promoting, general and administrative bills are commonly known as SG&A. Taking a glance at Other complete revenue (OCI) and its relation to Web Income is worth the effort.

Each of those elements performs a vital position in offering a complete view of a company’s monetary performance and the entire change in its fairness, aiding stakeholders in making informed selections. This would free the assertion of profit or loss and different complete earnings from the need to formally to categorise gains and losses between SOPL and OCI. This would minimize back complexity and gains and losses could solely ever be recognised as quickly as. Complete earnings is often listed on the financial statements to include all different revenues, expenses, features, and losses that affected stockholder’s fairness account during a interval.

Bar Cpa Apply Questions: Proprietary Funds Statement Of Cash Flows

The future of complete earnings reporting holds the promise of higher readability, relevance, and utility for all stakeholders. As the monetary panorama continues to evolve, so too will the strategies and practices of reporting, making certain that comprehensive earnings stays an important software for understanding a company’s financial well-being. Comparative evaluation, on the other hand, includes examining the differences and similarities in how entities report their complete income. This evaluation can reveal insights into the financial methods and performance of firms throughout different industries or areas. For example, a comparative evaluation of tech giants like Apple and Samsung may present completely different approaches to income recognition or the handling of currency fluctuations, which may considerably influence the reported comprehensive revenue.

It solely refers to modifications in the net assets of a company as a outcome of non-owner events and sources. For example, the sale of inventory or purchase of treasury shares isn’t included in comprehensive earnings because it stems from a contribution from to the company owners. Likewise, a dividend paid to shareholders just isn’t included in CI as a outcome of it is a transaction with the shareholder. The statement of comprehensive income displays both net income details and other comprehensive revenue details. It is appreciated for its extra complete view of an organization’s profitability image for a selected period. A company’s earnings statement particulars revenues and expenses, including taxes and interest.

Frequent examples for retailers and manufacturers embrace investment revenue, interest expense, and the gain or loss on the sale of kit that had been used within the enterprise. Different Complete Earnings (OCI) refers to any revenues, bills, and gains / (losses) that not have but been realized. These gadgets, similar to a company’s unrealized gains on its investments, are not acknowledged on the earnings assertion and don’t impact net income. It consists of realized and unrealized gains and losses, providing insights right into a company’s monetary well being, compliance, and investment stability.

In other words, the quantity allotted to expense is not indicative of the financial worth being consumed. Similarly, the amount not yet allotted isn’t an indication of its current market value. Insurance Expense, Wages Expense, Promoting Expense, Curiosity Expense are bills matched with the time frame within the heading of the revenue assertion. Beneath the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. The assertion of complete revenue incorporates a couple of amounts that aren’t reported on the revenue assertion.

Explanation Of Each Part In The Context Of The Instance

Since the company just isn’t in the business of promoting long-term belongings, the quantity acquired isn’t included in its operating revenues. Instead, only the gain or loss on the sale is shown on the earnings statement after the working earnings. The preparation of the Statement of Complete Income involves a scientific process to make sure accuracy and compliance with accounting standards. The key steps include identifying applicable revenues and expenses, recognizing components of Different Comprehensive Income (OCI), and calculating the total comprehensive income. The Statement of Comprehensive Earnings includes a quantity of key elements and line gadgets that present an in depth view of a company’s financial efficiency over a interval. These components include working income, non-operating earnings, Other Complete Earnings (OCI), and the tax impression on OCI.