QuickBooks Payroll shows you the paycheck details for all workers on the subsequent page (the preview). This web page offers comprehensive pay run details, together with knowledge like employee and employer taxes and contributions to medical health insurance and retirement plans. These hours should come in mechanically, but you can, in fact, enter hours for particular pay and make different last-minute changes manually. If you have questions or must make changes as you put together the payroll, you’ll find a way to seek the guidance of employee pages with out dropping your place or the information you entered.

The table that displays your staff and their present payroll hours is customizable. You can use the horizontal scroll bar to see as many columns as you want. QuickBooks Payroll used to share payroll data with QuickBooks Time, but Intuit has since integrated lots of that app’s instruments into the previous.

Besides, QuickBooks does not automatically course of local taxes; you need to do this manually at your finish https://www.intuit-payroll.org/. OnPay calculates, files and pays local tax obligations mechanically. We were impressed by QuickBooks Online’s automation instruments, which stand above some competing platforms we reviewed.

QuickBooks Payroll is a full-service payroll for small businesses that have to get began quickly. Its stay professional steering, skilled review and support, 24/7 chat service and sturdy information database are excellent even for first-time customers. We like that QuickBooks Online’s mobile app provides you an overview of your small business activity and helps you accomplish a number of accounting tasks wherever you are. The app permits you to view dashboard data, create and ship invoices, and settle for funds. You can even capture receipts and attach them to bills, reconcile transactions, view customer info, and message prospects. Throughout our test run, we discovered the app well-organized and easy.

What Forms Of Help Does Quickbooks Payroll Offer?

Many modern payroll software solutions are designed to streamline payroll processing, cut back errors, and ensure compliance with ever-changing tax legal guidelines and laws. By investing in dependable payroll software program, you possibly can decrease the danger of expensive mistakes and penalties, whereas maximizing effectivity and accuracy in your payroll operations. Whether you are a small enterprise proprietor or running a big company, having the best payroll software program could make your life a complete lot easier.

- They will walk you through setting up your chart of accounts, connecting your financial institution accounts and automating processes.

- That means if you’re already utilizing a variety of the company’s software program, you’ll be succesful of share knowledge between apps.

- QuickBooks On-line is a cloud-based accounting software resolution for small businesses, whereas QuickBooks Payroll is a cloud-based small-business payroll solution.

The Ultimate Verdict: Is Quickbooks Online Payroll Worth It?

The capability to customize your reporting precisely to your needs might help you optimize your funds and easily spot issues. It’s additionally a fantastic choice if you don’t want to have separate payroll or funds software because the capacity to deal with every thing in one place may be extremely handy. As you’ll find a way to see from this QuickBooks Premier review, the software is a strong decide, which is why it made our record of the highest accounting software for small companies.

On the other hand, if you love QuickBooks On-line but aren’t thrilled about QuickBooks Payroll, you’ve dozens of choices. Opponents like Gusto, Paychex, OnPay—honestly, most payroll software program solutions—all sync simply with QuickBooks On-line. Despite being primarily a payroll suite, there are also some HR functionalities, like group administration, well being advantages and an employee portal. All plans can also observe revenue and expenses, manage receipts, bill and settle for funds, monitor enterprise miles, ship estimates and manage 1099 contractors.

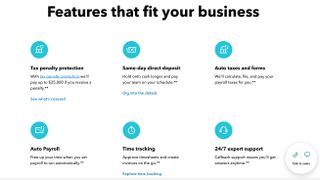

One Other companion, Guideline offers a 401(k) plan with automated contributions or employer-set contributions quantities. Each QuickBooks plan comes with 24/7 buyer help by way of chat, and Payroll Premium and Elite prospects have access to full-service 24/7 customer help. If you sign up for the Elite plan, you’ll be able to select a callback choice to limit the time spent waiting on the cellphone. Notably, Intuit outsources HR help to a third-party company, Mineral. This is worth contemplating when you plan to add the company’s HR services to an current payroll account. QuickBooks Payroll is designed to dovetail with over 15 Intuit product choices, together with POS and time tracking instruments in addition to the varied QuickBooks accounting solutions.

QuickBooks Online Payroll provides loads of features spanning payroll processing, worker administration, time monitoring, HR, and advantages administration. The bulk of the software’s misplaced points come from its native tax help limitations and restricted HR integrations. QuickBooks Online Payroll is a full-service payroll processing software program answer from Intuit that works immediately with QuickBooks Online. QuickBooks Payroll enables you to monitor time, run payroll precisely, fill and submit forms, file and pay taxes in time and extra to stay compliant. However, on the upside, most of their payroll plans include 1099 e-filing, workers’ compensation companies, and another useful features. They also supply intuitive mobile apps, easily-accessible worker portals, and naturally, a reliable payroll infrastructure.

You can entry the employer website by way of a mobile net browser, so it seems and works just like the desktop website. I was able to run a payroll and see reviews, simply with some additional scrolling. The only time I needed to zoom in was on the payroll particulars web page, but that’s a large table. Some small enterprise accounting sites integrate with standalone payroll applications like OnPay and Gusto.